Due Dilgence

A dynamic set of activities involving working with many unknowns identified via an iterative process

What is due diligence?

Due diligence is an investigative process that identifies, verifies and confirms the claims of another party. It is also an effective process used to uncover risks and highlight important issues, providing valuable insight to companies before they sign a new contract, form a partnership or make an investment.Why is due diligence vital to your business?

Due diligence helps companies to identify risk areas and key issues, but it can also reveal opportunities that help you in negotiation. Without due diligence, your company may encounter activities that could disrupt your operation and hurt your reputation later.Why perform due diligence?

- Quantify the real risk of a financial transaction, particular if the transaction takes place in a jurisdiction unfamiliar to you

- Assist in accurate decision-making

- Identify red flag issues

- Provide leverage for business valuation and negotiation

- Verify that investment or acquisition criteria have been met

- Ensure the other party or company is trustworthy

- Meet legal compliance and/or get regulatory approvals

Types of due diligence provided by TAQEEM Intelligence

Financial due diligence

Financial due diligence is a comprehensive and investigative process aiming to assess a company’s financial strengths by examining its financial data, which may include historical sales, expenses and working capital, as well as key assumptions used in management’s forecast. The aim of financial due diligence is to help investors see if the deal is worthwhile and have a better understanding of the potential risks and opportunities before signing on the dotted line. Financial due diligence is typically carried out before mergers and acquisitions. Other circumstances that warrant financial due diligence may include when a company looks to get additional funding or when it is in dispute with another organisation.Legal due diligence

Legal due diligence reviews legal risks that exist in a company, stemming from its organisation structure to contracts that it has with its suppliers, clients, partners and also employees. In addition, how the upcoming deal is structured may also have legal implications.

COMMON AREAS THAT OUR LEGAL DUE DILIGENCE TEAM REVIEWS INCLUDE:

- Ownership of a company (share certificates issued to board members, directors or key stakeholders)

- Management structures

- Company procedures

- Legal obligations such as loans

- Ongoing litigation, if any

Human resource due diligence

Human resource due diligence assesses the risks and opportunities pertaining to the employment structure of a company. It usually includes HR operations, employment contracts, grade and salary bands, leave policies, benefits, as well as any on-going disciplinary cases. The aim is to understand the company culture of a target company and see how it can facilitate a smooth transition.International due diligence

This form of due diligence is vital to companies that already have operations in numerous countries and legal jurisdictions or are planning to go international. International due diligence is the process of acquiring and analysing local information not publicly available outside of the location.

COMMON AREAS THAT OUR LEGAL DUE DILIGENCE TEAM REVIEWS INCLUDE:

- Verification of a foreign business partner or client

- Political situations in another country

- Local economic landscape

- Potential risks pertaining to local illegal activity and/or corruption

- Other local issues

Over many years, we’ve developed a network of trusted intelligence experts in Europe, the Middle East and the Far East, including in countries which the UK government and the European Union would classify as ‘high risk’. The list of high-risk countries changes from time to time, but essentially they are countries said to be vulnerable to corruption, support money-laundering schemes, or even have regimes that are linked to terrorism financing. If your organisation has rushed to invest in one of these countries, you or your company may become a victim of the country’s distinctive political systems or policies. This is why companies turn to our international due diligence team first. We are here to help you verify a foreign company’s legitimacy and undisclosed facts, along with the business environment in that particular country.

Due diligence methodology

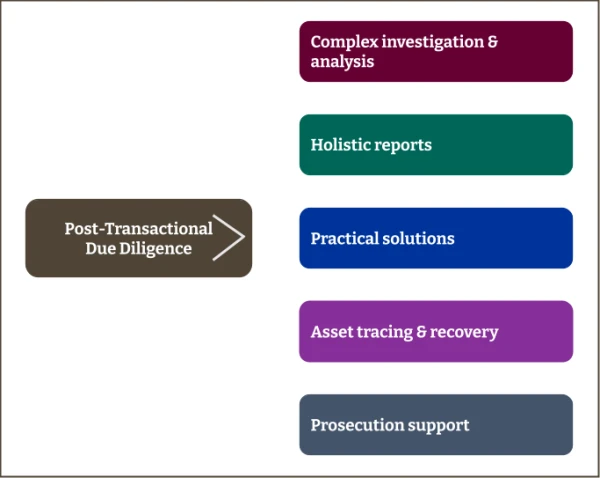

Generally, most companies conduct due diligence before making a financial commitment – which we call it pre-emptive due diligence. Increasingly though, companies realise that post-transactional due diligence is instrumental in helping them reduce the damage caused by an unexpected event or help them recover from the situation. Here’s a snapshot of pre-emptive due diligence and post-transactional due-diligence.

Pre-emptive due diligence

Prevention is better than cure and initiating due diligence before an important transaction can save your company time, money and many problems. In essence, pre-emptive due diligence is a risk-reduction process. It starts by us gathering intelligence from various sources rigorously – the more complex the pending business transaction is,the greater the level of effort we would invest in collecting the information to characterise the risks.Post-transactional due diligence

Sometimes even thoroughly planned business transactions can result in issues that put your company at risk and make you ask, “What had happened?”, “How could I prove it?” and “How do we minimise the damage?” – to answer these questions, a review on legal, financial, technical, operational, or even environmental can help company directors to unearth information that can be used to contain the damage, salvage the reputation, and recover from the situation.